Co-parenting can present several financial challenges, one of which is managing the financial contributions by each parent.

In an ideal situation, parenting is the shared responsibility of both parents, and decisions are jointly made, and in the best interests of the children. However, in many cases, the ideal situation is not present. This can lead to an uneven financial burden on one parent. This parent may subsequently find themselves covering a disproportionate share of the children’s expenses.

The impact of unequal financial contributions

The emotional toll on the parent trying to manage the financial responsibilities for the children can be profound. It’s not just a matter of euros and cents; it’s a reflection of the power dynamics and control exerted by the co-parent. Feelings of frustration, resentment, and stress can arise as one parent navigates the challenges of providing for their children while grappling with the unfair financial burden.

When tax policy is used to manipulate

Situations can arise where one parent utilizes specific tax credits that would be more appropriately applied by the other parent, who is in a less favourable financial situation. Below are two examples of this;

- Where both parents are taxed as single persons, but the Single Parent Child Carer tax credit is not being used by the parent most in need of it.

- Where the parents are still taxed as a married couple, and one is using the unused tax credits of the other due to the difference in salary. However, the one on the lower salary isn’t paying maintenance as they believe they shouldn’t have to due to the tax benefit the higher earner receives while still being taxed as a married person.

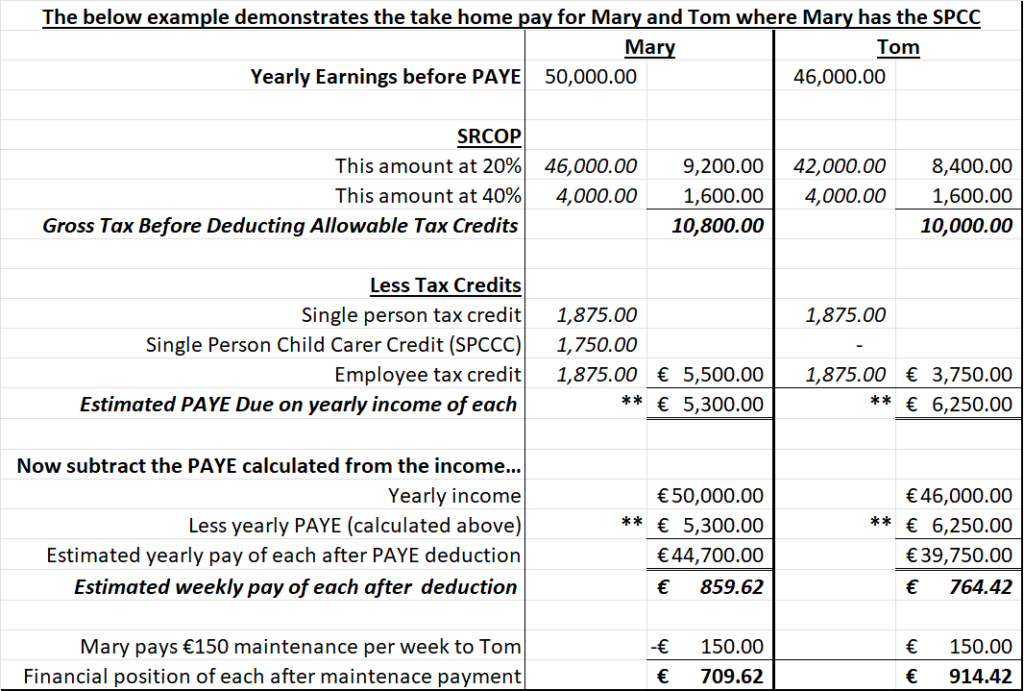

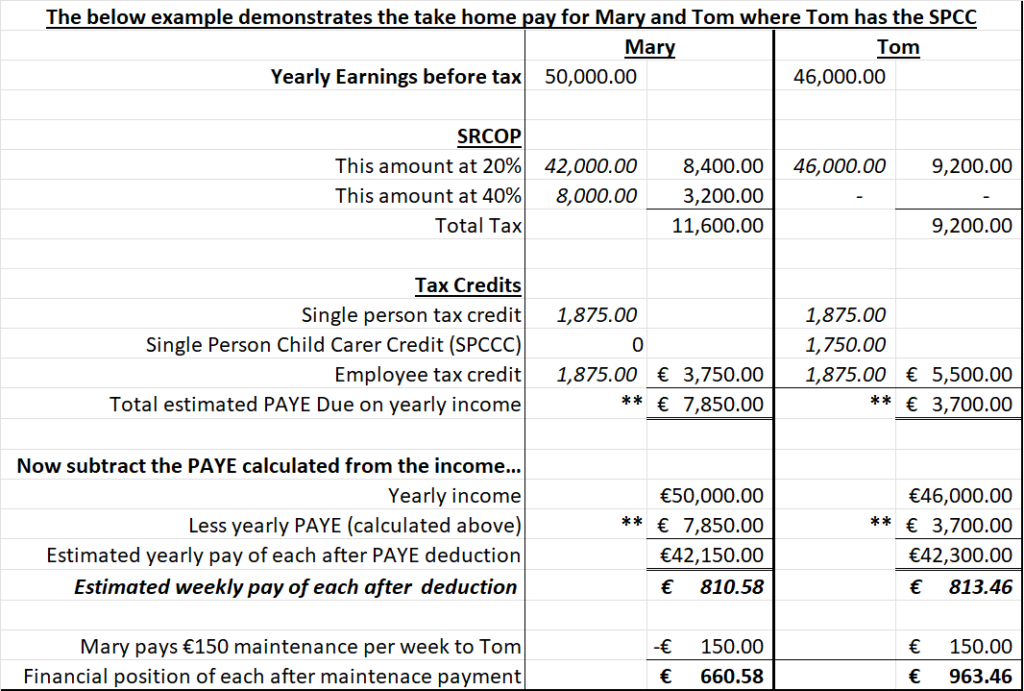

In both examples above, the financial reality becomes clear when the figures are set out on paper. When the individuals have the correct figures calculated for them, they can then make an informed financial decision on the best option for them. I’ve provided a worked through calculation below of the first example stated above. This explains in detail how the financial position of both individuals are impacted depending on who utilises the tax credit.

Example 1 – Single Parent Tax Credit

Revenue allows one parent to claim the single parent tax credit when they are raising the children alone. You can find further details and eligibility criteria on this tax credit here. Only one parent can claim this tax credit, even if the parenting is shared 50/50. In 2024, this tax credit is worth €1,750, in addition to an increase of €4,000 in the standard rate cut off point.

The below scenario sets out the living and financial situation of a separated couple; Tom & Mary (fictional names!).

Tom and Mary separated 4 years ago and have two children. Both Tom and Mary work fulltime, with Mary earning more than Tom. Tom agreed to give Mary the single parent tax credit as her income is higher. Mary has agreed to pay Tom €75 maintenance per week, per child, €150 in total per week.

The children live with Tom as their primary carer and spend the weekends with their mother Mary. Although Mary gives child maintenance to Tom, Tom has full responsibility for taking care of the children. Tom also incurs childcare costs to assist take care of the children after school while he is at work. As the income currently stands, Mary is benefiting from the extra tax credit, but its Tom who has more of the caring responsibility, on top of the additional financial costs that come with raising children. Even though Mary pays €150 maintenance per week, she benefits from a tax reduction of just under €50 per week due to the Single Parent Child Carer credit.

This situation is not an equal and fair distribution of the financial costs by Mary and Tom. In situations like this, either Mary should contribute more financially, or Tom takes the single person child carer tax credit, as he has most of the responsibility and associated costs of taking care of the children.

Calculations explaining the discussion above on example 1

This example is simply taking PAYE into account and nothing else. I’m keeping it simple so it’s easier to understand. PRSI and USC would still be deductible from their respective incomes, in addition to any other deductions they are liable to.

The main point to take from the above example is that it is always important to calculate the final figures for everyone involved to ensure there is an equal distribution of financial responsibility between both parents. An equal distribution of financial responsibility will help to prevent resentment building between the parents.

Strategies for coping with the challenges of co-parenting

Open Communication: Encourage open communication with the co-parent about the importance of shared financial responsibilities. While this may be challenging, expressing the need for fairness in contributing to the children’s well-being is a crucial step.

Documentation: Keep detailed records of financial transactions, contributions, and expenses related to the children. Having clear documentation can be invaluable in negotiations, particularly legal proceedings when seeking to address the financial disparities. In situations where financial abuse is present, this is imperative. To learn more about financial abuse, click here.

Unequal financial contribution in co-parenting situations is undeniably challenging, but it’s crucial to recognize there are practical steps co-parents can take to navigate these difficulties. In situations where communications have broken down and you cannot afford the assistance of a financial coach or advisor, there are plenty of online resources that can assist you to calculate your net pay in various scenarios. Click here to try the net pay calculation tool on the Deloitte website. There are many others on the internet to choose from. A simple search for net pay calculators will display a few to choose from.

Recent Comments